Company Formation In Dubai UAE

We’re here to help you expand beyond borders with the support you need for smooth offshore growth.

Talk to Our Expert Consultants &

Start Your Business

Offshore Company Formation in UAE

Setting up an offshore company in the UAE allows you to operate outside mainland restrictions while gaining key benefits like tax breaks, privacy, asset protection, and flexible operations. This setup is perfect for businesses focused on global expansion without engaging in local trade.

The UAE offers three main locations for offshore setups: Ajman Offshore, Ras Al Khaimah (RAK), and Jebel Ali Free Zone (JAFZA). Each of these areas provides tax savings, confidentiality, and secure asset management, making them a strong choice for international business.

Steps to Setup a

UAE Offshore Company Formation

Select Your Jurisdiction

Choose RAK or JAFZA as your base both offer tax benefits, privacy, and asset protection.

Fulfill Government Fees

Pay required fees on time to stay compliant and keep your setup active.

Determine Your Business Activity

Ensure your chosen activity meets local rules and regulations.

Appoint a Registered Agent

Assign an agent to handle official documents and compliance.

Why Register an Offshore Company in Dubai?

Setting up an offshore company in Dubai has many perks:

- A supportive legal framework for business

- Flexible regulations that adapt to your needs

- No income tax requirements

- Strong asset protection

- Access to international markets

- Easy access to global funding

Offshore Company Formation In UAE

Setting up an offshore company in the UAE provides a flexible, tax-efficient solution for businesses looking to operate internationally while enjoying financial privacy. With PRO Smart’s guidance, you can streamline the offshore formation process from registration and documentation to account setup.

Frequently Asked Questions

Offshore company formation lets you operate globally while being registered in the UAE. It’s ideal for tax efficiency, asset protection, and international business.

The most popular offshore jurisdictions are JAFZA (Dubai), RAK ICC (Ras Al Khaimah), and Ajman Offshore - each known for reliability and investor-friendly policies.

Choose a jurisdiction, submit the required documents, and register your company name. We handle approvals, incorporation, and bank account setup for you.

Each jurisdiction offers different benefits - from privacy and taxation to ease of banking. The right one ensures your business runs smoothly and legally.

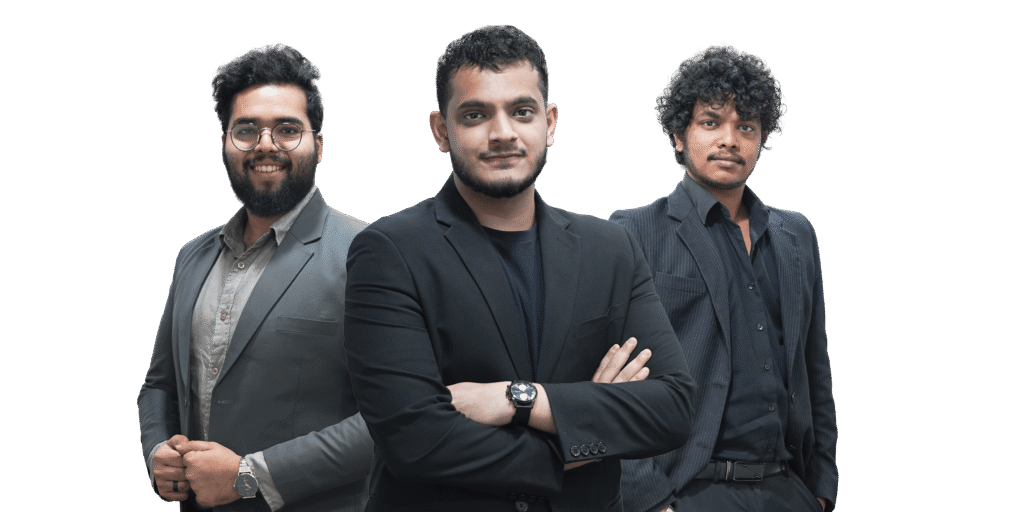

Let’s Build Your Business in Dubai

PRO Smart Business Services is your trusted partner for business setup and growth in the UAE. Our team has helped hundreds of entrepreneurs, investors, and companies establish and expand successfully. We provide tailored solutions from company setup to PRO services, Golden Visas, and beyond. Reach out to start your business journey today.